The economic landscape of 2026 has been defined by significant shifts in trade policy and federal revenue collection. One of the most discussed initiatives this year is the $2,000 Tariff Dividend proposal, a plan aimed at redistributing federal tariff revenue directly to American households. As of February 2026, this proposal continues to shape fiscal discussions, though its immediate impact on your monthly budget depends on several evolving factors.

Understanding the $2,000 Tariff Dividend Proposal

The concept of a tariff dividend was introduced as a mechanism to return funds collected through import duties to the public. The primary objective is to provide a “dividend” to citizens, specifically targeting low- and middle-income earners. According to recent economic impact research, the proposed $2,000 per-person rebate is intended to function as a one-time windfall to help offset the rising costs of consumer goods associated with higher tariffs.

While the administration has touted the plan as a way to use record-setting tariff collections for direct public benefit, the implementation remains a subject of intense debate among policymakers and financial experts.

Current Status and Timeline for 2026 Payments

As of early February 2026, the $2,000 tariff checks have not yet been approved for distribution. While President Trump initially suggested a mid-2026 rollout, more recent statements in January indicated that if approved, the payments might not arrive until the latter half of the year.

Current updates suggest:

- Legislative Approval: The Treasury Department has clarified that formal authorization from Congress is required to release these funds.

- Legal Challenges: The Supreme Court is currently reviewing the legality of certain emergency-power tariffs, which could directly impact the availability of revenue for these dividends.

- Official IRS Guidance: The IRS newsroom has not yet issued a formal schedule for these payments, as no legislation has been signed into law as of February 8, 2026.

Who is Eligible for the Proposed Dividend?

Eligibility criteria are a central part of the current proposal. The goal is to ensure the dividend reaches those most affected by trade-related price increases. Based on the most recent framework:

- Income Thresholds: The dividend is likely to be capped at an annual adjusted gross income (AGI) of $100,000 for individuals.

- Excluded Groups: High-income earners will not be eligible for the payment.

- Family Structure: Some models suggest the payment could be per-person, meaning a family of four could potentially receive up to $8,000, depending on the final legislative design.

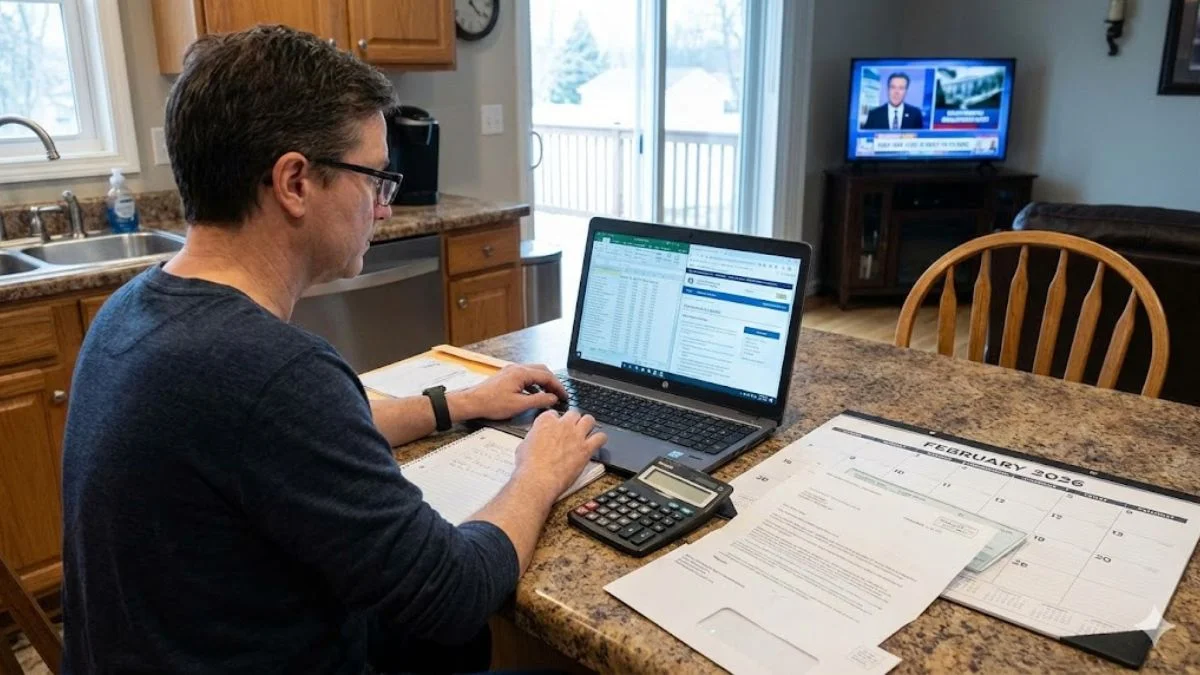

Impact on Household Budgets in February 2026

While the $2,000 payment is not yet in bank accounts, it is already influencing how Americans plan their 2026 budgets. Economists at the Tax Foundation note that the average household tax burden has increased due to tariffs, with some estimates suggesting a $1,300 to $2,100 impact per family this year.

For your February budget, the dividend remains a potential future asset rather than a current source of liquidity. Financial advisors suggest that taxpayers should not account for these funds in their immediate essential spending plans. Instead, focus should remain on navigating the current price levels of imported electronics, automobiles, and household goods, which have seen fluctuations due to ongoing trade policies.

Key Challenges and Legislative Hurdles

The primary obstacle to the $2,000 dividend is the funding gap. Nonpartisan analyses from the Committee for a Responsible Federal Budget indicate that a $2,000 per-person dividend could cost between $450 billion and $600 billion annually. Currently, projected tariff revenues for 2026 may only cover a portion of this cost, leading to concerns about increasing the federal deficit.

Furthermore, several members of the House and Senate have argued that tariff revenue should be prioritized for national debt reduction rather than direct stimulus-style payments. This internal disagreement makes a February breakthrough unlikely, shifting the focus toward a potential legislative package in the spring or summer.

Warning Against Tariff Dividend Scams

With the widespread media coverage of the $2,000 proposal, federal authorities have warned of an increase in fraudulent activity. Scammers are reportedly sending texts and emails asking for banking information to “register” for the tariff dividend.

It is important to remember:

- No Registration Required: If approved, the IRS would use existing tax return data to issue payments.

- No Fees: There is never a fee to receive a government payment.

- Official Sources Only: Trust only information from official “.gov” websites regarding the status of your stimulus or dividend checks.

As of today, the $2,000 Tariff Dividend remains a high-profile proposal with significant implications for the American economy, but it has not yet reached the implementation phase.

Frequently Asked Questions

Has the $2,000 tariff dividend been approved for February 2026?

No, the proposal has not yet received the necessary congressional approval or a finalized rollout date as of February 2026.

Who qualifies for the proposed $2,000 tariff check?

The current proposal targets low- and middle-income Americans, likely restricted to individuals earning less than $100,000 annually.

When can Americans expect to receive the tariff dividend payments?

Presidential statements suggest a potential delivery toward the end of 2026, though this is contingent on legislative and legal developments.

A former Wall Street analyst turned independent advisor, Mike specializes in retirement planning, 401(k) strategies, Social Security optimization, and late-career financial moves for everyday Americans.