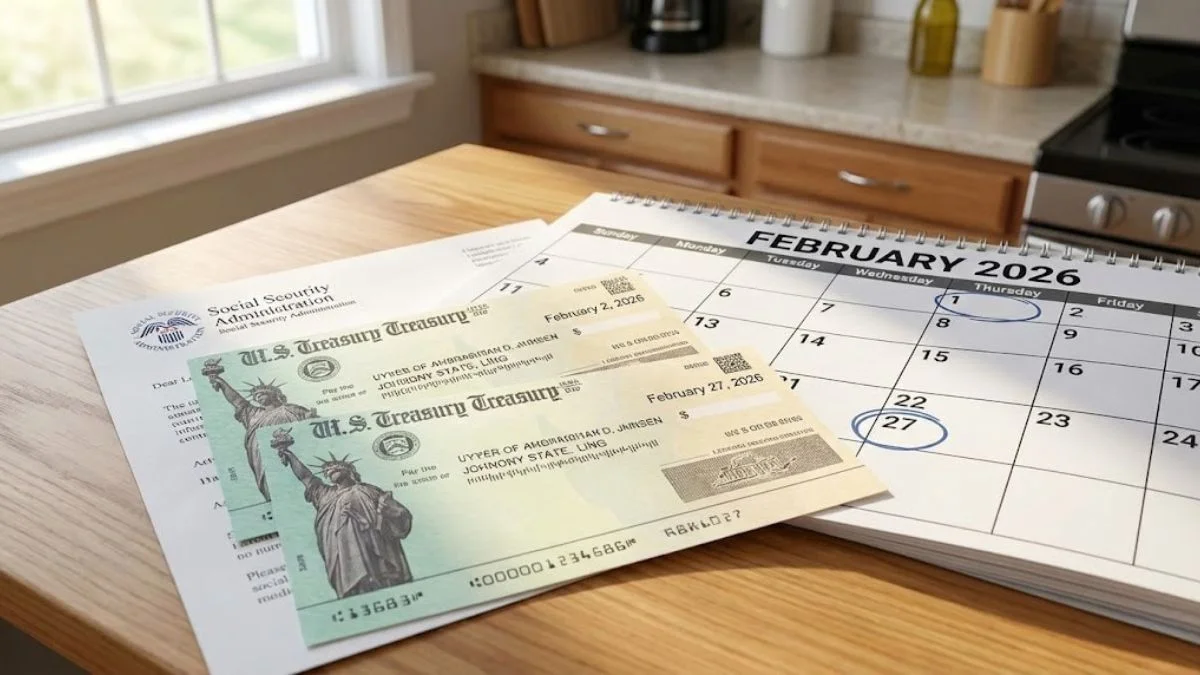

The Social Security Administration (SSA) payment schedule for February 2026 features a specific timing shift that results in some beneficiaries receiving two separate payments within the same month. This occurrence is not due to a bonus or an error but is a direct result of how the federal calendar aligns with standard payment rules.

For millions of Americans relying on Supplemental Security Income (SSI) and Social Security benefits, understanding these dates is essential for managing monthly expenses like housing, utilities, and healthcare.

The Impact of the 2026 Calendar Quirk on SSI Payments

The primary reason for the shift in payment dates is a long-standing SSA policy regarding weekends and federal holidays. By law, if the first day of the month falls on a Saturday, Sunday, or a federal holiday, the Social Security Administration must issue SSI payments on the closest preceding business day.

In February 2026, the calendar creates a unique situation:

- February 1, 2026, falls on a Sunday. Consequently, the SSI payment for February was advanced and issued on Friday, January 30, 2026.

- March 1, 2026, also falls on a Sunday. To ensure recipients have their funds by the start of the month, the SSA will issue the March SSI payment on Friday, February 27, 2026.

Because the March payment arrives before the end of February, it can appear as though recipients are getting an “extra” check, when in fact, it is simply the March benefit arriving early.

Who Qualifies for Two Payments in February?

While many SSI recipients will see the March payment arrive on February 27, a specific group of beneficiaries will technically receive two distinct types of checks from the SSA during the month of February. These are known as dual beneficiaries.

Dual beneficiaries are individuals who receive both Supplemental Security Income (SSI) and regular Social Security benefits (such as retirement, survivors, or SSDI). According to the official 2026 payment schedule, their payments are distributed as follows:

- February 3, 2026: This is the scheduled date for regular Social Security payments for those who receive both SSI and Social Security, or those who filed for benefits before May 1997.

- February 27, 2026: This is the early delivery of the March SSI payment.

For these individuals, two government deposits will hit their accounts within the 28 days of February.

Understanding the 2026 Cost-of-Living Adjustment (COLA)

All payments issued in February 2026 reflect the 2.8% Cost-of-Living Adjustment (COLA) that went into effect in January. This increase was implemented to help beneficiaries keep pace with inflation and rising costs for essential goods.

The 2026 COLA amounts for SSI are standardized as follows:

- Individual Maximum: $994 per month.

- Couple Maximum: $1,491 per month.

- Essential Person: $498 per month.

These amounts represent the federal base rate; however, actual payments may vary based on individual income, living arrangements, and any state-level supplements.

February 2026 Social Security and SSI Payment Schedule

The SSA staggers its payments throughout the month to manage the high volume of transactions. For those who receive only retirement or disability benefits (and not SSI), the payment date is determined by their date of birth:

| Birth Date | Payment Day | Date in February 2026 |

| 1st – 10th | Second Wednesday | February 11, 2026 |

| 11th – 20th | Third Wednesday | February 18, 2026 |

| 21st – 31st | Fourth Wednesday | February 25, 2026 |

It is important to note that Presidents’ Day, a federal holiday, falls on Monday, February 16, 2026. While the holiday does not fall on a scheduled Wednesday payment date, bank processing may be slightly affected for those expecting checks around that time.

How to Manage the Early March Payment

Financial experts advise beneficiaries to budget carefully when an early payment occurs. Because the payment arriving on February 27 is intended to cover expenses for the entire month of March, there will be a longer gap until the next scheduled payment on April 1, 2026.

Recipients are encouraged to monitor their accounts via the My Social Security portal to verify deposit amounts and ensure their direct deposit information is up to date. If a payment does not arrive as scheduled, the SSA recommends waiting three business days for bank processing before contacting a local field office.

Frequently Asked Questions

Is the second payment in February an extra bonus?

No, the payment received on February 27 is the March SSI benefit arriving early due to March 1 falling on a Sunday.

Why did I receive a payment on February 3 and February 27?

This typically happens for dual beneficiaries who receive both regular Social Security and SSI; the two payments represent two different benefit programs.

Has the SSI amount changed for February 2026?

Yes, all February payments include the 2.8% COLA increase that became effective in January 2026, raising the individual maximum to $994.

A former Wall Street analyst turned independent advisor, Mike specializes in retirement planning, 401(k) strategies, Social Security optimization, and late-career financial moves for everyday Americans.