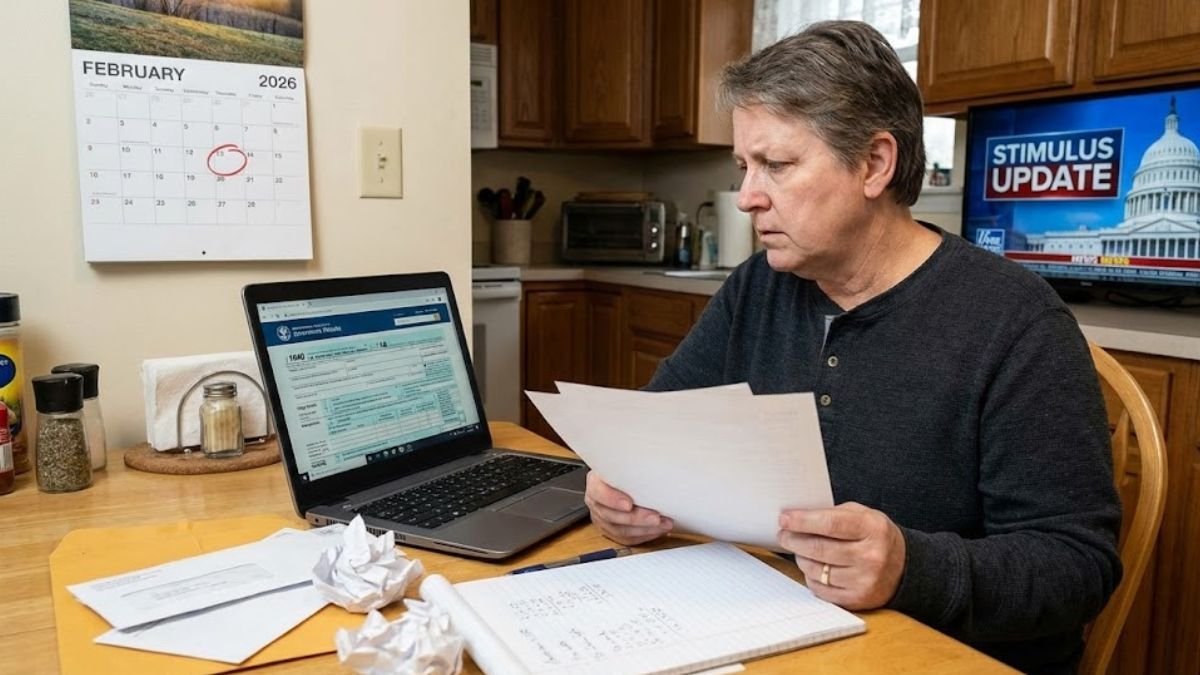

As of early February 2026, discussions regarding a new federal payment, often referred to as the $2,000 Tariff Dividend, have gained significant attention. While the Internal Revenue Service (IRS) has officially opened the 2026 tax filing season, it is important to clarify that this specific $2,000 stimulus check remains a legislative proposal and has not yet been signed into law.

Status of the $2,000 Tariff Dividend Proposal

The proposal for a $2,000 direct payment is primarily linked to the “One, Big, Beautiful Bill” and the administration’s trade policy. The concept involves redistributing revenue collected from foreign tariffs directly to American households.

According to recent White House statements, the administration is committed to exploring these “dividend” payments as a way to offset costs for working families.

However, for these payments to be issued, the proposal must first pass through the U.S. Congress. Under Article I of the Constitution, only Congress has the authority to levy taxes and authorize federal spending.

Currently, no formal legislation for the $2,000 check has been finalized or approved by both the House and the Senate.

Proposed Eligibility Requirements for the $2,000 Check

While official IRS guidance is not yet available because the bill has not passed, administration officials and economic advisors have outlined the following projected eligibility criteria:

- Income Thresholds: The payments are expected to target low- and middle-income individuals. Preliminary discussions suggest an income cap of approximately $100,000 per year for individuals.

- Tax Filing Status: Eligibility would likely be determined based on the most recent tax returns on file (Tax Year 2024 or 2025). This includes Single, Head of Household, and Married Filing Jointly statuses.

- Residency and Dependency: Similar to previous economic impact payments, recipients would likely need a valid Social Security number and must not be claimed as a dependent on someone else’s return.

- Working Families: Treasury officials have emphasized that the “dividend” is intended for “working families,” though specific definitions regarding employment status have yet to be codified in a bill.

Legislative Process and Potential Timeline

President Trump has suggested that if the legislative hurdles are cleared, the $2,000 checks could potentially be distributed by mid-2026. However, several factors could influence this timeline:

- Congressional Approval: The bill requires a majority vote in both chambers of Congress.

- Judicial Review: The legality of the tariffs used to fund the checks is currently under scrutiny by the Supreme Court. A ruling against the administration’s tariff authority could impact the funding source for the dividend.

- IRS Implementation: Once a bill is signed, the Internal Revenue Service would require time to update its systems and establish distribution protocols.

Comparison with Previous Economic Impact Payments

Unlike the stimulus checks issued during the 2020-2021 period, which were funded by federal deficit spending as emergency relief, the 2026 proposal is framed as a “dividend” from trade revenue.

This distinction means the eligibility and funding mechanisms are tied more closely to the success and legality of national trade policies rather than a direct response to a pandemic or recession.

Important Warnings: Avoiding Scams and Misinformation

The IRS has issued warnings regarding an increase in fraudulent communications. Taxpayers should be aware of the following:

- No Application Required Yet: There is no “form” or “application” to fill out to claim a $2,000 stimulus check at this time.

- Direct Contact: The IRS does not initiate contact via text message, social media, or unsolicited emails to request personal or financial information.

- Official Sources: Information regarding federal payments will always be posted on official government websites (.gov).

While millions of Americans await further news, the current focus for taxpayers should remain on the 2026 filing season and claiming existing credits, such as the Child Tax Credit and the Earned Income Tax Credit, which have been expanded under recent tax law changes.

Frequently Asked Questions

Has the $2,000 stimulus check been approved for 2026? No, the $2,000 payment is currently a proposal that requires Congressional approval and has not yet become law.

Who would be eligible for the $2,000 check if the bill passes? Initial proposals suggest eligibility would be limited to low- and middle-income individuals and families, likely with an income cap around $100,000.

When would the 2026 stimulus checks be sent out? If the proposal is passed by Congress and signed into law, administration officials have estimated a potential distribution date around mid-2026.

A former Wall Street analyst turned independent advisor, Mike specializes in retirement planning, 401(k) strategies, Social Security optimization, and late-career financial moves for everyday Americans.